Hidden Deals: Haggling and mental health in the telecoms market

Ar y dudalen hon

- At a glance

- Foreword by Citizens Advice

- Foreword by Money and Mental Health Policy Institute

- 1. Introduction - Avoiding the Loyalty Penalty

- 2. The experiences of haggling with telecoms providers for people with mental health problems

- 3. Sludgy consumer journeys: bad for all consumers, even worse for some

- 4. Conclusion

- 5. Endnotes

- 6. Methods

Acknowledgements

This report was written by Nina San, Tess Thompson, Conn Doherty and David Mendes da Costa, with input and support from Anne Pardoe, Oliver Heath, Claire Farrell, Tamara Siddiqui, and many others.

At a glance

Foreword by Citizens Advice

Mobile and broadband services are vital to keep us connected to work and school, to access benefits, and so much more. But despite being essential services, pricing in these telecoms markets can be a minefield. Accessing the right deal at a fair price is not always easy or straightforward, and at a time when people are struggling with every bill, this really matters. In this report, we bring together two areas which have been a focus for us at Citizens Advice. The first is the loyalty penalty, the extra cost loyal consumers pay if they don’t switch providers at the end of a contract. The second is choice architecture, when firms design consumer journeys to manipulate peoples’ decisions.

We’ve been talking about the loyalty penalty since 2018. Seven years on we've seen significant changes in the insurance sector but in telecoms people can still end up paying more than they should if they stay with the same provider when their contract ends. So far, much of the response to the loyalty penalty in this market has been focused on switching, but there are good reasons why this doesn’t work for everyone. This report shows that we need to look more closely at what happens when people want to stay with their provider but find that there are barriers to discovering and accessing the best deals and avoiding the loyalty penalty - in particular the expectation that you need to ring up and haggle to get at the real deals, which are hidden out of sight.

Through our work on choice architecture, we’ve seen that the design of consumer journeys not only makes it harder for people to get the best prices, but can also unfairly impact consumers in vulnerable circumstances. We’ve done research into this before, and seen that processes designed to make it harder for consumers to get the outcomes they want impact certain consumers more than others. This report shows how a particular group of consumers, people with mental health problems, are more likely to lose out in the telecoms market because of the ‘sludge’ of the haggling process.

We hope this report will start a much needed conversation about pricing in the mobile and broadband markets, and the expectations put on customers to navigate this market. By understanding how the current approach doesn't work for those in vulnerable circumstances, we can start to move towards a market that works better for everyone.

Tom MacInnes, Director of Policy

Foreword by Money and Mental Health Policy Institute

For the majority of people, haggling is a fairly uncomfortable experience. It can be embarrassing, stressful and leave you feeling worried about whether the price you ended up paying in the end was a fair one.

But for people with mental health problems, haggling is often not just a difficult experience, it can be essentially impossible. Difficulty making telephone calls, anxiety caused by confrontation, challenges remembering and processing information to enable you to compare complex bundled prices - it’s easy to see the barriers mounting up.

The need to haggle to get a lower price in telecoms is just another example of a market feature that is disproportionately bringing poor outcomes to people with mental health problems, specifically because of how it interacts with the symptoms of their conditions.

We were proud to support Citizens Advice in this research, which reveals just how difficult it can be for people with mental health problems to negotiate a better deal. 85% of respondents from our lived experience Research Community told us their mental health makes haggling more difficult. Many feel stuck, paying over the odds for services they rely on simply because the system assumes all consumers have the same ability to navigate it. And when people with mental health problems are already three and a half times more likely to be in problem debt, £10 or £20 a month really does matter.

This research raises important questions about fairness, inclusion, and whether we should accept that some groups essentially have fewer consumer rights than others, because the processes that exist to exercise them are fundamentally inaccessible.

Helen Undy, Chief Executive

1. Introduction - Avoiding the Loyalty Penalty

In competitive markets, if you want to find the best price then you need to shop around. But in many markets, consumers who don’t shop around not only miss out on the very best prices but are actively penalised by prices that creep up each year or jump up significantly when the offers made as part of their contract come to an end. We call the way that long-term customers are penalised in this manner, the ‘loyalty penalty’.

In 2018, Citizens Advice submitted a super-complaint to the Competition and Markets Authority (CMA) on the loyalty penalty. This work led to a ban on the loyalty penalty in general insurance, however, the loyalty penalty remains a feature in the telecoms market. When a customer comes to the end of a fixed-term contract like a broadband or mobile phone plan, they can often see their payments shoot up if they don’t take action. According to Ofcom, broadband customers who are out of contract pay on average £11 a month more than those who are in-contract - a loyalty penalty of £132 a year. And each April, most mobile and broadband contracts are subject to above inflation annual price rises, which add to this loyalty penalty.

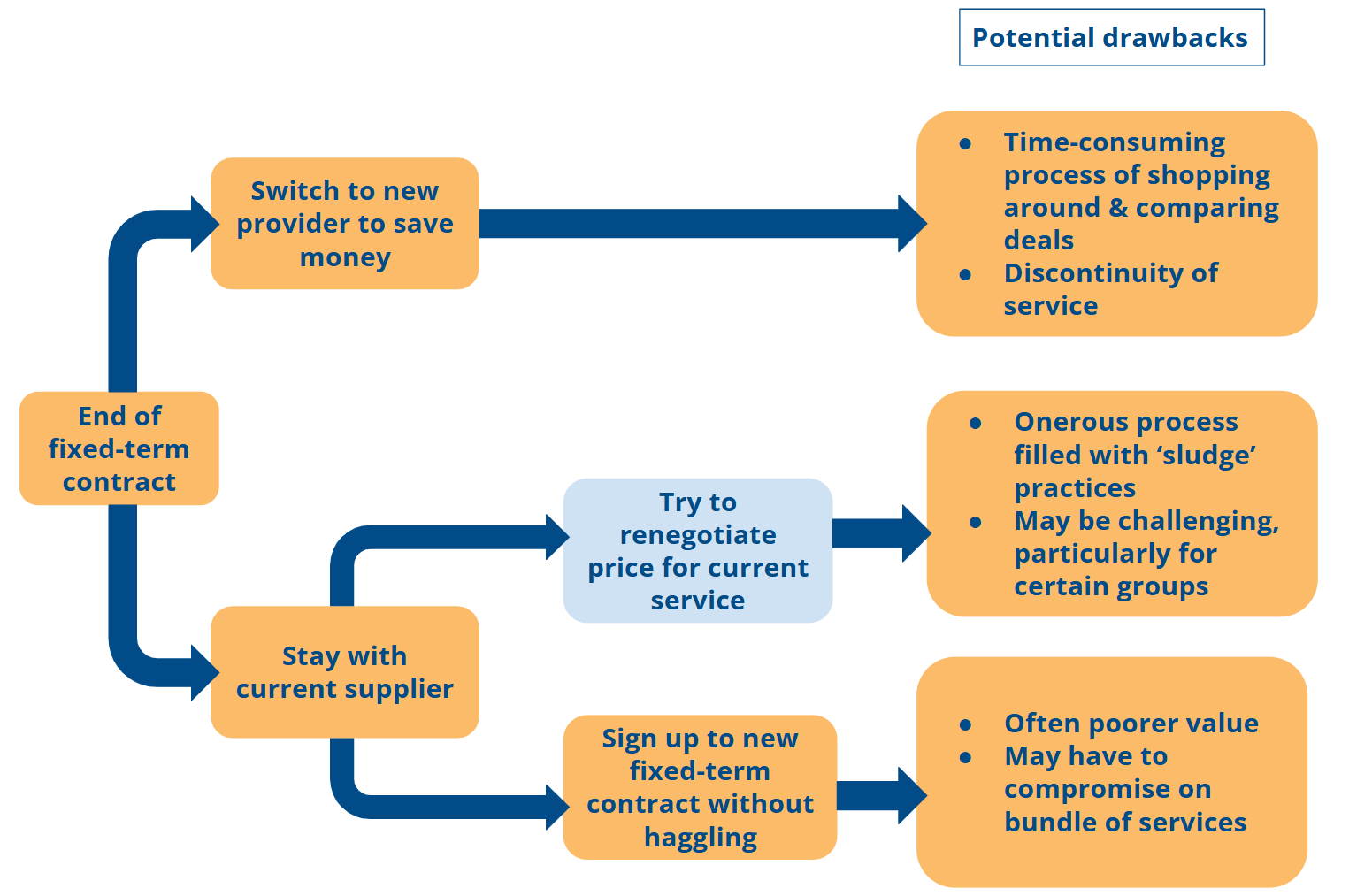

At present, to try to avoid paying this loyalty penalty 1.07 MB , consumers have two options. They can either switch providers or take out another contract with their current provider. Much regulatory focus has been on the first of these options, with regulators looking to make it easier to switch and shop around. As we have highlighted previously, there are limitations to this approach. In previous research 891 KB of the mobile and broadband sector, we found that only 1 in 3 people say they always shop around for the best deals. Those that don’t explain that it's because shopping around is too time consuming (31%), stressful (26%) or difficult (17%).

Moreover, there may be good reasons why people want to stay with their existing provider, including having disclosed information about their (vulnerable) circumstances which they don’t wish to repeat, wanting to avoid initial set up costs or feeling that the service which they receive from their existing provider is better than the competition.

“I also choose companies with good or excellent customer service. I will explain that I have mental health issues and ask them to be patient, generally they are. Especially my current provider - I have been with them for about 7 years - prior to finding them, I would change providers every time my contract expired, but they have been exceptional both in customer service and quality of services provided.”

Expert by experience

In this report we focus on the second option which has received less attention by regulators: getting a new contract with your current provider. In particular, we look at the process of haggling.

If you want to stay with your current provider but avoid the loyalty penalty, it's now 'normal' to pretend that you want to leave your contract, just so you'll be directed to the disconnection department where your provider will offer cheaper prices that were otherwise unavailable. We call these ‘hidden deals’ - lower prices that some consumers can find if they’re willing and able to call up to negotiate, prices which are often not available when looking online.

We’re concerned that haggling for one of these hidden deals may not be as accessible to some consumers as it is for others. As part of polling conducted in 2023, we explored how confident different groups of consumers feel about phoning up their mobile or broadband provider and haggling for a better deal. We found that just over one third (36%) of all mobile and broadband consumers aren’t confident doing this - but for those with chronic mental health problems, this increases substantially to over half (52%). We also found that those with chronic mental health conditions who struggle to haggle were likely to be paying more than those with no mental health problems - spending around £150 extra per year across their mobile and broadband bills.

We wanted to understand more about why people with mental health problems may find it harder to access good value deals in the mobile and broadband market by renegotiating with their provider. So we commissioned the Money and Mental Health Policy Institute to explore the issue in detail through a survey of their panel of experts by experience. This research revealed barriers throughout the consumer journey that make it particularly difficult for some people with mental health problems to effectively renegotiate with their provider and successfully access a cheaper hidden deal. The findings, set out in the following chapter, raise important questions about whether all consumers have equal access to the best value deals offered by providers.

Figure 1: End of contract options and potential drawbacks

2. The experiences of haggling with telecoms providers for people with mental health problems

Money and Mental Health’s research and policy work is informed by their Money and Mental Health Research Community, which is a group of several thousand people with lived experience of mental health problems or caring for someone who does. Money and Mental Health conducted an online survey between 15th March – 25th March 2024. The survey was completed by Research Community members (also known as experts by experience), with a total of 331 members taking the survey.

Respondents were asked about their experiences of trying to get a better deal on their home internet, landline or mobile phone contract. The survey took a mixed methods approach, with both quantitative and qualitative questions. The quantitative questions focused on the different parts of the consumer journey, in order to quantify the proportion of respondents who experienced challenges at different points in the journey. The qualitative questions allowed respondents to describe how they felt about negotiating with their provider; this generated rich data on how the negotiation process impacted people’s lives and emotional wellbeing more broadly.

2.1 Barriers in the process of renegotiating a better deal

Even after getting over the initial hurdle of deciding to try and renegotiate for a better deal, the Money and Mental Health analysis finds that there are significant hurdles for people with mental health problems at numerous stages of the negotiation process. In this section we break down these stages of haggling and look at the factors within each that can make people with mental health problems struggle to engage with the process effectively.

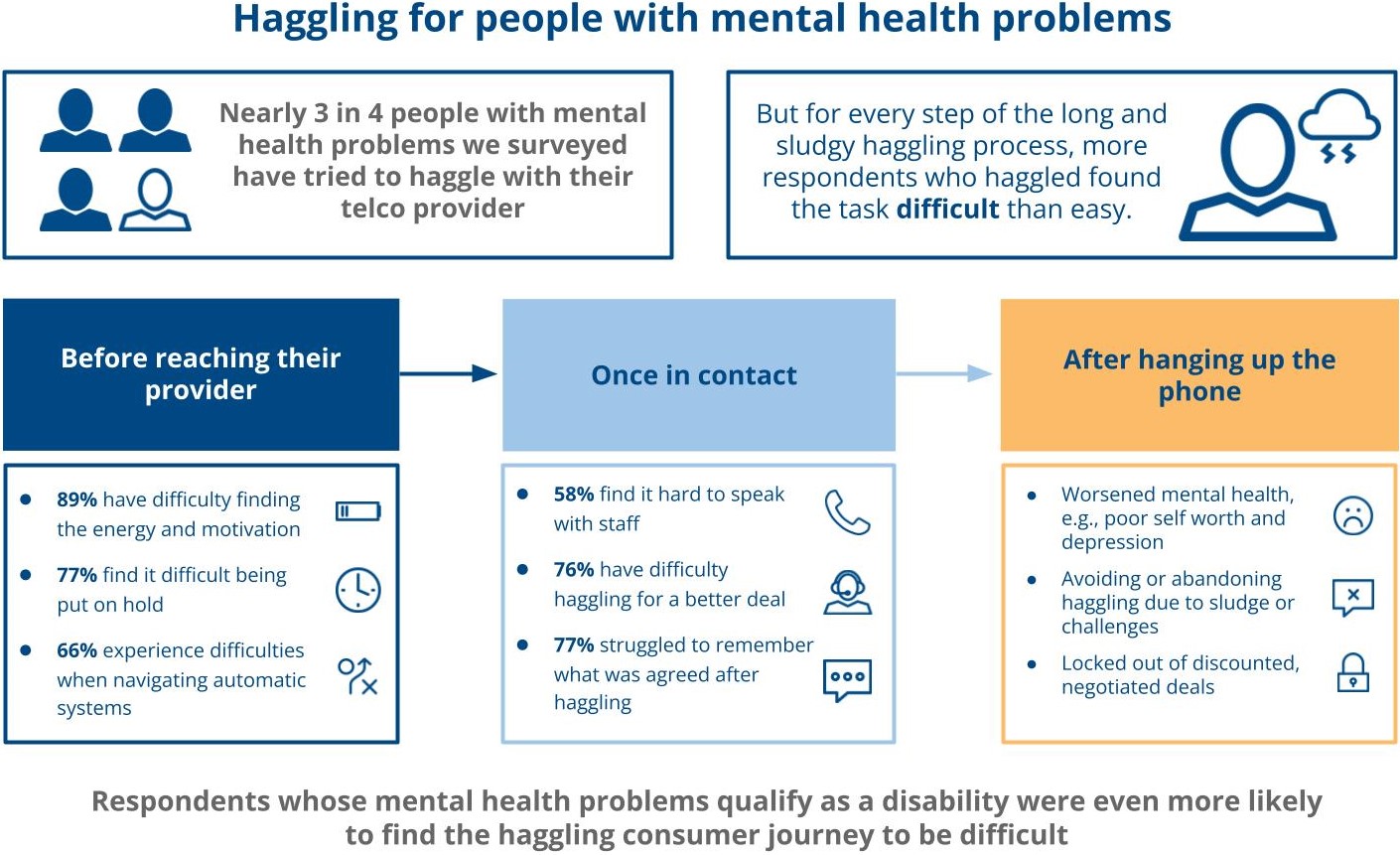

Figure 2: Barriers for people with mental health problems in the haggling consumer journey

Preparing to call

The survey analysis uncovered two key challenges at the first stage of the haggling consumer journey, when people are preparing to call their service provider. It found that these challenges stem in part from the cognitive impacts associated with mental health problems, such as low motivation. These difficulties are compounded by a haggling consumer journey filled with sludge, which presents an additional hurdle to overcome. By sludge we mean design elements that are deliberately included in a consumer journey to make certain decisions harder (for example, ending a contract).

a) Finding the motivation and energy to get in touch

89% of research participants who had tried to haggle reported finding this difficult.

Many respondents found calling their provider to be a daunting prospect. They described how finding the motivation to have a lengthy and complicated conversation with their mobile or broadband provider can feel impossible, especially when even simple tasks require enormous effort.

b) Getting the right contact details

56% of research participants who had tried to haggle reported finding this difficult.

Some respondents reported that they faced challenges in locating the correct number to call. This chimes with reporting that highlighted how contact numbers are often buried deep within provider websites. Locating these details can be particularly difficult for people with mental health problems experiencing challenges with concentration and attention span.

“My mental health fluctuates a lot day-to-day, and I would only do the call to haggle on a day I am feeling well because it requires motivation and ability to focus. The problem I therefore come across is that sometimes if I am feeling unwell for days or weeks on end I can automatically end up on the more expensive deal for a few weeks until I can get the headspace to be able to deal with the switching or haggling process - so can end up losing out money as a result.”

Expert by experience

Trying to get through

The research found that participants also encountered challenges at the next stage of the consumer journey, when they attempted to contact their provider. The findings detail two key challenges here: being put on hold, along with navigating automatic systems and getting through to the right person.

c) Being put on hold

77% of research participants who had tried to haggle reported finding this difficult.

Many respondents experienced feelings of anxiety when put on hold while contacting their provider to negotiate. This often led to heightened stress levels immediately prior to engaging in conversation with the provider.

d) Navigating automatic systems and getting through to the right person

66% of research participants who had tried to haggle reported finding this difficult.

Moving through call menus requires careful listening and on-the-spot decision making. Respondents talked about how this can be more challenging when struggling with mental health symptoms that impair focus and the ability to process information. In addition, if people find themselves being passed from one staff member to another, this can heighten their anxiety further.

“My mental health, physical health and neurodivergence make it difficult to make calls particularly if you then have to go through menus and have to wait, and especially if talking to a bot. I need direct access to a kind human who speaks clearly and is easy to understand. But that can only happen if I’m well enough to deal with it even though I feel so angry and hurt that I’m being taken advantage of because of my disabilities.”

Expert by experience

Speaking to staff

Lastly, the survey analysis turned to the challenges experienced at the final phase of the consumer journey, when a customer is engaging with staff. Here, the research found evidence of interpersonal challenges, as well as processing and memory difficulties in relation to the information they are provided.

e) Speaking with staff

58% of research participants who had tried to haggle reported finding this difficult.

After reaching the correct department, respondents detailed how they could often find it challenging to talk to staff. Mental health symptoms meant that people often found it difficult to communicate clearly and remember the pre-planned script in their head.

f) Haggling for a better deal

76% of research participants who had tried to haggle reported finding this difficult.

Respondents talked about how they found it challenging to advocate for themselves in the face of sales tactics and unsupportive staff. Poor mental health can include a range of cognitive symptoms that impact on daily functioning; these symptoms made it difficult for some respondents to process the information provided to them.

g) Remembering what was said

77% of research participants who had tried to haggle reported finding this difficult.

Some respondents detailed how they struggled to remember what was agreed at the close of a conversation.

“Any face-to-face or over-the-phone real time conversations can be incredibly hard to navigate. I often forget my words, forget to ask important things, allow the other party to control the direction of the conversation, put too much trust in a sales person, and generally get high anxiety in this kind of pressure environment. Given that if the negotiations aren't successful, it may need to all take place all over again with a different supplier, is just too much.”

Expert by experience

The numbers above paint a stark picture. At every stage of the consumer journey, more participants said that they found the task difficult than easy. The tasks that people found particularly challenging included finding the motivation and energy to get in touch, being put on hold, the act of haggling with their provider and then remembering what was discussed. The survey analysis detailed how mental health symptoms can make haggling particularly difficult. This occurs in the context of a lengthy and complex consumer journey, which is sometimes marked by a lack of flexibility or understanding from the provider.

2.2 The negative impacts of trying to negotiate

Trigger warning: This section contains a brief mention of self harm and suicidal thoughts

Respondents detailed how these challenges along the consumer journey can lead to them taking one of a number of actions, each with associated adverse outcomes. Some respondents either avoided or did not complete the haggling process because of the challenges involved, which in some cases negatively impacted their emotional wellbeing. As a result, this cohort was excluded from accessing any discounted, negotiated deals. Other respondents completed the process but did so with considerable difficulty, and again at the expense of their emotional wellbeing.

Money and Mental Health analysis shows that haggling has a range of potential impacts upon a person’s wellbeing. This includes negative emotional impacts (such as frustration, anger, distress), which are felt long after the negotiation process itself is over. And these can compound some of the existing features of poor mental health, such as poor self worth and feeling depressed. The analysis also found that haggling can be detrimental to a person’s day-to-day functioning, due to the exhaustion and emotional upheaval experienced while negotiating.

“It makes me anxious and leaves me mentally exhausted. Should I cook dinner for my family or try and get a better deal on the internet? Surely I don’t have energy for both.”

Expert by experience

While the negotiation process can be frustrating for many consumers, the above demonstrates how it can be even more harmful to consumers with mental health problems, if that stress triggers or exacerbates existing serious impacts of their mental health problems. At the most severe end, a small number of participants detailed how the negotiation process fed into more severe symptoms of poor mental health, such as self harm and suicidal thoughts.

2.3 Mental health problems and essential services

Previous research from both Citizens Advice and Money and Mental Health has shown that individuals with mental health problems can struggle with navigating essential service markets. Whilst no two peoples’ experiences of mental health problems are the same, there are some common cognitive impacts associated with mental health problems which are helpful for understanding why this might be the case. [1]

A lack of motivation can make it hard to prioritise things like getting a better broadband deal when even more basic day-to-day self-care tasks are difficult to stay on top of.

A short attention span and difficulty concentrating can make tasks like comparing deals or remembering contract information much harder.

Lots of mental health problems are associated with unreliable memory, which can make it tough to track bill due dates or contract expirations.

Impulsivity can lead to people with mental health problems entering unfavourable or poor-value contracts without fully understanding the terms or longer-term consequences.

Reduced problem-solving skills can hinder the comparison and evaluation of different complex deals.

Some mental health problems can also cause difficulties with communication, making it challenging for people to both communicate their needs and preferences clearly, and to effectively understand what others, for example service suppliers, are communicating.

These various cognitive challenges often mean consumers with poor mental health are already on the back foot when they come to the end of a fixed-term mobile or broadband contract. As one respondent to the survey summarised this experience:

“Because I find it too difficult to look at making any changes, or start a new contract - I become overly anxious and then get too wound up in my head to do this - I have recently changed phone contract but my husband had to do it for me - I get far too panicky and then brain fog descends and I cannot read or listen to anything correctly. It is too hard and too difficult.”

Expert by experience

This means that even getting to the point of considering trying to renegotiate a better deal can be far from easy for many people with mental health problems. Although almost 3 in 4 research participants said they had at some point contacted their mobile or broadband provider to try and negotiate a better deal, 85% said that they felt their mental health problems made negotiating more difficult.

3. Sludgy consumer journeys: bad for all consumers, even worse for some

Our new research shows that there are many reasons why consumers with mental health problems might find the process of accessing a hidden deal particularly challenging. But for any consumer trying to access a better deal from their broadband or mobile provider, the sludgy negotiation process can get in the way of good consumer outcomes. Excessive friction in this consumer journey is worrying for both these reasons - for its impact on specific consumer groups and its broader impact across telecoms consumers.

3.1 Broad impacts of sludge

Consumer journeys filled with excessive frictions that get in the way of consumers getting what they want or need are often referred to as containing ‘sludge’. The CMA has detailed how sludge practices can be found in both online and offline business practices, leading to both financial losses for consumers and wider negative impacts, such as frustration and anxiety. And the Financial Conduct Authority’s (FCA) Consumer Duty sees sludge practices as ‘harmful friction’ that firms should avoid using, because they discourage consumers from taking action in their best interests.

It is clear that a consumer journey of haggling for a better deal is already filled with excessive friction for all consumers. Finding the time and energy for a potentially confrontational phone call; waiting on hold for a substantial period of time; navigating automated systems; remembering complex verbal information; haggling assertively with a call handler - any consumer seeking a better price from their provider will have to jump through most, if not all, of these hoops. Sludge is never a positive feature of any consumer journey, but it is particularly concerning where consumers need to take action to avoid being penalised or receiving a poorer value service.

The combination of sludge and a lack of transparency about what kinds of deals are available to those who haggle may have wider market impacts too, making it difficult for consumers to trust providers and for providers to fairly and effectively compete for business.

3.2 Jumping through hoops: mental health disabilities and negotiation

While the overall process of haggling for a better deal is filled with sludge, this new research helps us to understand why consumers with mental health problems may be disproportionately impacted by the various hoops they have to jump through to negotiate a better deal for a mobile or broadband deal over the phone. They face significant challenges to successfully negotiate for a better deal — and often face harmful after-effects from attempting this mode of engagement.

Mental health symptoms such as low motivation can make it difficult for people with mental health problems to take action. The challenges in the haggling consumer journey come not only from having to pro-actively contact providers but the fact that this needs to be done on the phone. This mode of communication can be particularly cognitively demanding and difficult for those with social anxiety. As a result, people experiencing these symptoms are more likely to fall prey to the loyalty penalty, which punishes inertia.

Our new research shows that these challenges are particularly marked for those with a long-term, pronounced mental health condition. Of the 331 survey responses, 182 respondents said their mental health problems impacted on their day-to-day activities a lot and were long-lasting, which could be classified as a disability under the Equality Act [2]. This cohort was more likely to say that they found the task difficult for each step of the consumer journey detailed in the previous section, compared to the whole group. For example, of the respondents whose mental health problems could class as a disability under the Equality Act and had tried to haggle:

86% found it difficult to remember what was agreed at the end of the conversation, compared to 77% of respondents overall

81% found haggling for a better deal difficult, compared to 76% of respondents overall

75% experienced difficulties when navigating automatic systems and getting through to the right person, compared to 66% of respondents overall

3.3 Impacts of sludge on other consumer groups

The CMA has previously highlighted how sludge practices are likely to have a disproportionate impact on certain groups of consumers, who for various reasons may have limited mental bandwidth to respond to all the imposed frictions. This includes disabled or older consumers, those on low incomes, and those with low digital confidence as example groups.

Worryingly, this suggests the specific challenges faced by consumers with mental health problems in trying to haggle for a better deal may also extend to other groups who are at particular risk of disadvantage, detriment and harm. This is something we plan to look at in future research.

4. Conclusion

This report is an initial dive into investigating the consumer harms associated with the haggling process in the telecoms market. We’ve seen that the consumer journey of negotiating for a better deal is filled with friction, and is marked by a lack of transparency and accessibility. But more concerningly, we have presented evidence that people from marginalised groups, in particular people with mental health problems, may be disproportionately impacted - raising questions about how this practice complies with the Equality Act or regulatory standards.

These are some of the key questions for regulators to consider following on from this research:

Is the process of haggling leading to poorer outcomes for certain consumer groups? For example, people with mental health problems, those with English as an additional language, and those on low incomes. And if so, is this because these groups are less likely to engage in haggling and/or is this due to the negative impacts that are experienced as a result of the process?

Is the general sludginess of the haggling process compatible with good outcomes for consumers in general, as well as the specific groups detailed above? How does the sludge in the haggling process relate to consumers’ ability to access fair value services in the telecoms market?

Is the practice of giving better deals or discounts to those who call up to renegotiate having wider negative impacts on markets - both in terms of consumer trust and effective competition?

We’ll be thinking about these questions too. In the next phase of this work, we’ll explore the impact of haggling on consumers overall and on those who might be hit harder by the practice, and look at hidden deals in the context of both the loyalty penalty and pricing transparency.

5. Endnotes

[1] These cognitive impacts are paraphrased from two Money and Mental Health Policy Institute reports:

'Levelling the playing field: how regulators can support consumers with mental health problems’ (2017) https://www.moneyandmentalhealth.org/wp-content/uploads/2017/12/Levelling-the-playing-field-Regulators-report.pdf

‘A summary of common ways in which mental health problems may affect financial capability’, published as part of the ‘Seeing through the fog: how mental health problems affect financial capability’ report (2017) https://www.moneyandmentalhealth.org/publications/fincap/

[2] Gov.uk When a mental health condition becomes a disability This is based on Money and Mental Health Policy Institute survey respondents’ own assessments of the impact of their mental health problem. However, in any individual legal case, it is for the courts to interpret how the Act applies and what action is reasonable.

6. Methods

The Money and Mental Health Policy Institute surveyed 331 UK adults from their Research Community, which is a group of several thousand people with personal experience of mental health problems. Money and Mental Health conducted an online survey of 331 adults for Citizens Advice. Fieldwork was conducted between 15th March – 25th March 2024.

Survey data relating to the car insurance market comes from a representative survey of over 6000 UK adults. Walnut Unlimited conducted an online poll of 6000 adults in the UK for Citizens Advice. Fieldwork was conducted between 30th September – 15th October 2024. The figures have been weighted and are representative of all UK adults (18+).

Survey data from 2023 that relates to haggling comes from a representative survey of over 4000 UK adults. Savanta conducted an online poll of 4000 adults in the UK for Citizens advice. Fieldwork was conducted between 14th – 22nd September 2023. The figures have been weighted and are representative of all UK adults (18+).